Blogs

RRSP/PRPP deduction limit Statement

RRSP Over Contributions

When I am preparing personal tax returns each spring, I encounter clients who have over contributed to their RRSP accounts. Unfortunately, it is too late at that point for me to rectify the problem without my client paying penalties to CRA.

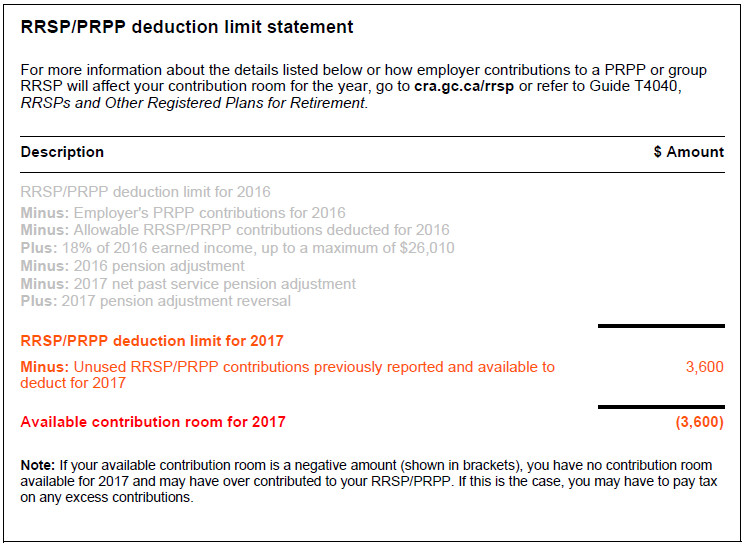

To avoid over contributing to your RRSP, refer to your notice of assessment for the prior year. This will give you how much contribution room you have (A) as well as any RRSP contributions carried over from the prior year that have not yet been claimed (B). A – B is the maximum you can contribute in the current year.

It is wise to refer to this information before you make RRSP contributions in order to avoid the hassle of over contributing.

But if you have over contributed to an RRSP here is what will happen:

- To the extent that the over contribution is greater than $2,000, you will be charged a penalty of 1% of the overage for each month that the amount remains in your RRSP.

- In order to report the overage and calculate the penalty, you should complete a T1 OVP form and submit to CRA. The form is not hard to complete once you get the hang of it, but you will need accurate information about when you made your contributions for the year in question. Payment for the penalty should be submitted at the time the form is filed in order to avoid interest.

- If you do not file the T1OVP, CRA will probably calculate the penalty for you. However, CRA does not have accurate information about when your RRSP contributions were made, so their penalty amount will probably be higher than if you calculated the amount yourself. For example, if you make the over-contribution in December, than your T1OVP penalty will only be 1% for that single month. If CRA calculates the T1OVP based on the contribution slip received from your financial institution, CRA may not know which month you made the contribution in and charge you up a 10% (March through December) penalty.

Sometimes, the over-contribution is temporary. Following my previous example, if you make an over contribution in December, you are only offside for one month if you have additions to your contribution room (through employment income, etc.) in the following year.

If the over-contribution situation is not temporary, you should withdraw funds from the RRSP. There are two ways to do this:

- Prepare Form T3012A requesting withdrawal of the amounts from the RRSP account without withholding tax. The form, along with three copies, is sent to CRA. Once CRA approves the withdrawal, you take the approved form to your financial institution and request a withdrawal of the funds. Make sure to hang on to one copy of the approved T3012A, as you will need to file a copy with your tax return.

- Request the withdrawal from your financial institution directly. This will result in taxes being withheld, but the taxes withheld will be considered taxes prepaid on your personal tax return.

The disadvantage to preparing a Form T3012A is that it takes CRA a significant amount of time to process the form. This will increase the number of months that you are charged the one percent penalty.

Now the final step! Under both withdrawal methods, you will receive a T4RSP slip to be included as income on your tax return. However, since you never received any tax benefit from the over contribution, there is an offsetting deduction. If you went the T3012 route, the amount of the withdrawal can go directly on line 232 of your tax return as a deduction.

Otherwise, complete Schedule 746 on your personal tax return, which will also feed through to Line 232. But the extra step is required if you do not have a T3012A.

RRSPs are one of the few ways someone can defer tax, and an important tool for saving for retirement. But it is important to stay within the contribution limits to avoid the headaches and financial pain of over contribution penalties.

Written by:

Jan Denham, CPA, CGA

Tel: 778-593-7565 ext. 24

Email: jdenham@everviewcpa.ca